Best Investment Option for Peer to Peer Lending with OMLP2P

OMLP2P, India's leading Peer to Peer Lending Platform, is founded and operated by a team of highly competent, successful and seasoned professionals with diverse experience in the fields of Banking, Finance and Digital Technologies.

At OMLP2P we follow a process-driven approach for evaluating and selecting the borrowers' profiles on 100+ parameters using customised proprietary credit scoring algorithm. We go beyond the traditional credit scoring model and assess the profiles to ensure high success rate of timely payment of EMIs. We also have a robust system to ascertain the borrower's ability to pay, along with their intent to pay.

Given our expertise, OMLP2P ensures optimal rate of returns to investor. Along with offering a Smart Investment Option, we also enable:

- High Returns: With P2P lending, investor can lend capital to borrowers and earn fixed returns on a mutually negotiated interest rate - as high as 36% and for a duration ranging from 12 months to 36 months and create a seamless passive income with regular monthly repayments.

- High Credit Quality of Borrowers: Every borrower profile undergoes a stringent credit and risk review on our state-of-the-art credit risk scoring platform. We ensure complete compliance of KYC (Know Your Customer) norms for every borrower.

- Loan Grades: At OMLP2P, 0ur risk grades for personal and business loan go all the way up to P7 & B7 with P1 & B1 being the safest. The classification is based on the estimated likelihood of the risk of defaults of the borrowers in paying their EMIs. In order to reward lenders for taking a higher risk, loans assessed with higher risk grades yield more interest.

For a conservative lender - select portfolio of very Low Risk to Low Risk (P1-P2-P3) (60-75%) and Medium Risk (25-40%) (P4-P5)

For a moderate risk lender - select portfolio of very Low Risk to Low Risk (P1-P2-P3) (40-50%), Medium Risk (40-50%) (P4-P5) and High Risk (10%) (P6-P7)

- Transparent: At OMLP2P, the entire investment and disbursal process is hassle-free and fully transparent. At the same time, we maintain high data security and safety standards to keep the data protected.

- Low Risk Investment: At OMLP2P, we use our proprietary algorithm developed in association with Equifax to select low risk quality borrowers. With strong assessment and collection mechanism, OMLP2P makes P2P lending much safer than many other investment options available. It is recommended to diversify the investment in terms of both loan purpose and risk category by investing a smaller amount of money in each loan. OMLP2P lists a number of loans on a daily basis.

Adequate diversification across as well as within categories helps to improve your risk-reward ratio.

- Regular Income & Auto Invest: Repayment of loans are structured in Equated Monthly Instalments (EMI), which will give regular income to the investors. Investors can select their investment criteria and if there is/are any loan requirement from the borrowers that fits the selected criteria, then the borrower will be automatically funded from the OML wallet.

**Refer to FAQ section for terms and conditions

P2P lending is a good investment than other investment assets

Financial Institutions provide limited products for investments and low returns on options such as fixed deposits. Mutual funds are limited with regards to the investors they attract as they require high capital commitments over a long period of time. Finally, equity markets are highly volatile and require a significant holding capacity and risk appetite and even then returns are not guaranteed. OMLP2P bridges this gap by offering a new income asset class that is not only relatively safe and secure, but also offers ROIs as high as 36% along with flexible investment tenure.

Key advantages of lending through OMLP2P are:

- Attractive returns - as high as 36%

- Wide range of Pre-verified creditworthy borrowers

- Detailed borrowers’ credit analysis by experienced professionals

- Wide variety of borrowers

- Recommended score and interest rate along with approved amount

- Escrow Payment Mechanism - Utmost transparency using trusteeship mechanism to transfer money

-

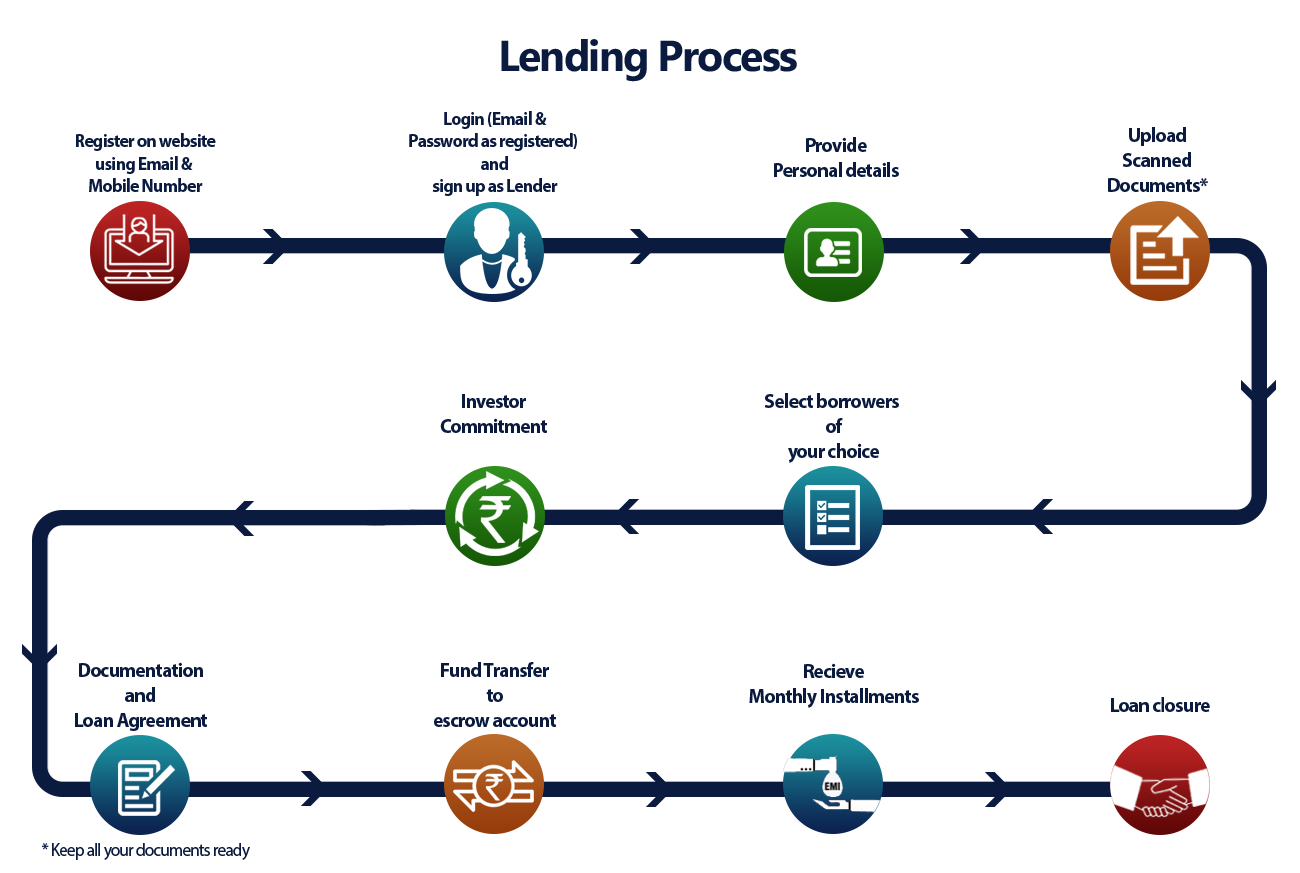

Investment opportunities for Lenders